Expend, a leading digital platform for business expense management, has announced a record uptake of their innovative product, Card Connect™. The company is the first in the UK to offer real-time processing of business expense data from Mastercard and Visa transaction feeds, directly integrated into its expense management platform.

Revolutionising Expense Management with Instant Processing

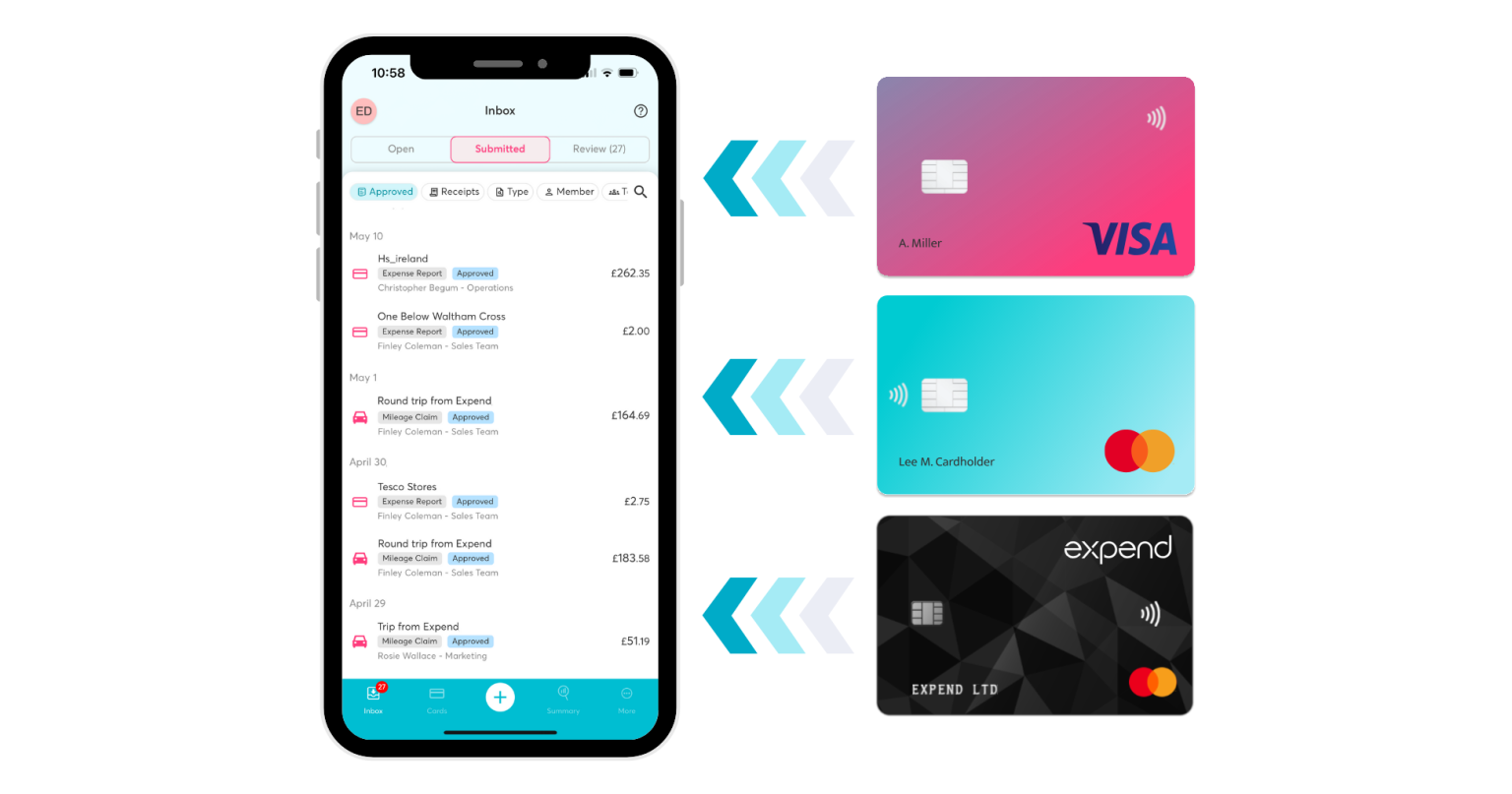

With Card Connect™, Expend clients can now benefit from instant expense settlement, simplifying financial processes and boosting operational efficiency.

He continues, “The second advantage is real-time visibility. Card payments appear in the Expend app immediately after the transaction occurs. There’s no delay between the payment and when it’s displayed on the platform.”

Streamlined Expense Submission for Employees

The convenience for employees is substantial. They can charge business expenses to their preferred Visa or Mastercard business cards, connect those cards to the Expend platform, and instantly process transaction data. Vowles clarifies, “Users can upload receipts, assign categories to the expense, and submit it for approval—all instantly through the app. For instance, team coffee expenses can be logged and submitted for approval before the coffee is even served.”

Efficient Management for Finance Teams

For managers and finance departments, Card Connect™ centralises the approval process. “All submitted expenses from different cards are managed in one place,” Vowles says. “This simplifies the approval process and reconciliation of accounts, removing the need for multiple banking apps and logins.”

Transforming Traditional Expense Management

Vowles emphasises the difference Expend’s innovation brings to traditional processes: “Managing expenses has long been a tedious task for companies of all sizes. Paper receipts, cumbersome claims processes, and lengthy approval workflows cause delays and frustration for finance teams and employees alike. Card Connect is part of our continued effort to revolutionise the market.”

He adds, “The flexibility of card choice is crucial for our clients. Many businesses use specific cards to accumulate travel points or other loyalty rewards. Expend’s card-agnostic approach ensures managers can keep their preferred credit arrangements while integrating seamlessly with our platform.”

Removing Manual Processing Burdens

Business credit card payments are often handled centrally by finance teams, taking up valuable time for manual reconciliation and review. Expend’s Card Connect™ alleviates this burden, eliminating manual data entry errors while simplifying the entire expense process.

When a Mastercard or Visa Business card is used through the Expend platform, Vowles explains, “a notification is sent to the cardholder, prompting them to submit their receipt via the app. This ensures expenses are tracked accurately and in real-time.

A Mission to Enhance Real-Time Visibility

Vowles concludes, “Our goal with Card Connect™ is to continue providing real-time visibility and zero-touch processing for business expenses. We are committed to meeting the evolving needs of our customers and offering a solution that simplifies expense management.